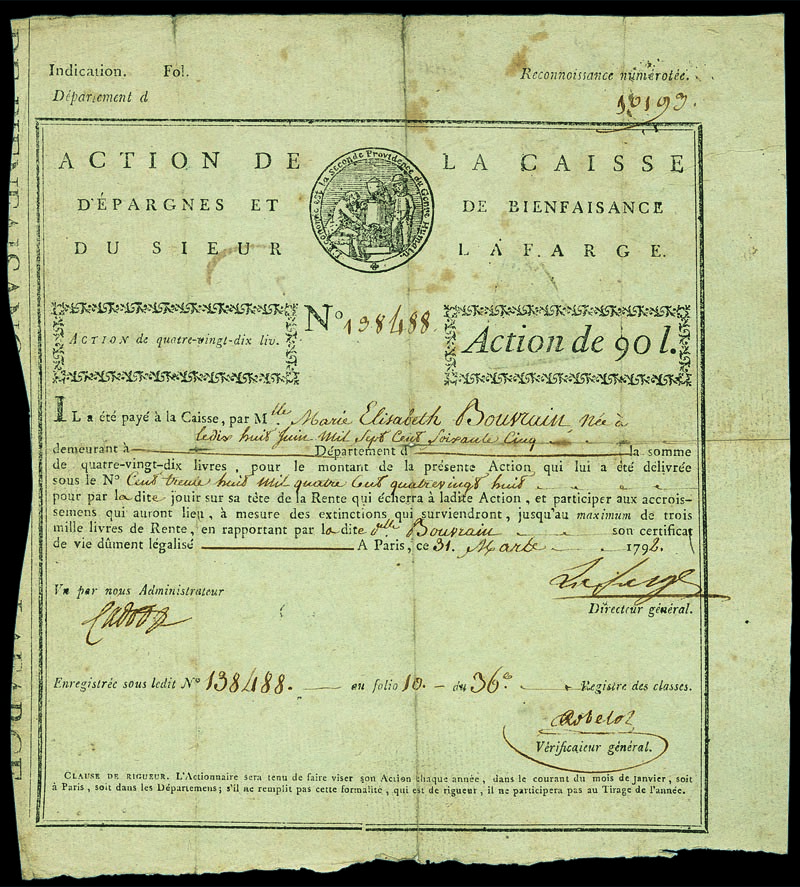

Auction: SW1008 - Bonds and Share Certificates of the World

Lot: 241

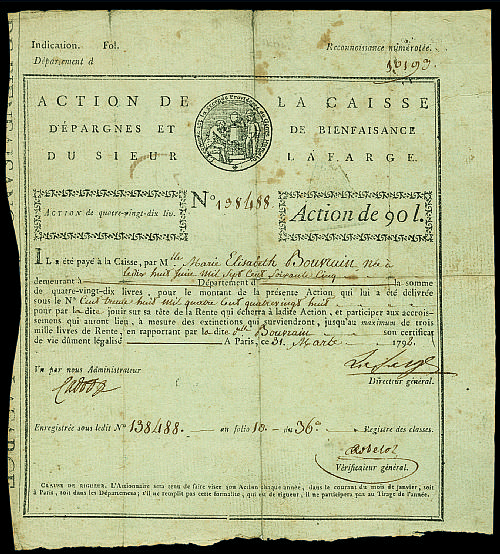

La Caisse d’Epargnes et de Bienfaisance du Seiur Lafarge. Share 90 Livres. Paris, 31. March 1792. Nr. 198488. The Caisse d’épargnes et de bienfaisance du Sieur Lafarge was by far the biggest tontine at the end of the 18th century. It represented an enormous innovation for the French financial system during the revolution. Mr. Lafarge (1748-1830) was of modest background. However he was a man who permanently was full of ideas and plans. In 1787 and again two years later, he submitted a plan of a “private tontine” to the King Louis XVI. Both times it was refused. In November 1790, as the French Revolution had started, Lafarge presented a new project to the Assemblée Constituante. He proposed a Company which organizes a tontine viagère. The tontine’s capital then was placed in state bonds. The representative Comte de Mirabeau was supportive of the proposal; however after a negative response from Maximilien de Robespierre, the project was rejected on the 5th March 1791. But Lafarge did not give up; he immediately drew up an adapted project, based on comments by the famous “Académie des science et des comités”. Only 21 days after the Caisse d’épargnes et de bienfaisance was finally accepted. The subscription of shares of the Caisse at Franc 90 each was open until 31st March 1792. It was a great success; in September 1793 the Company had collected more than 50 Million Francs and had nearly 120’000 shareholders. The Company went through difficult times. In the year of the revolution VI the Caisse lost nearly two third of its assets when the government debt was consolidated. However it continued to pay out to its shareholders. In 1808 the Commune de Paris took over the administration of the Caisse. In 1884 the yearly payment was an impressive 6’000 Francs per share. In 1888, the last shareholder died and the tontine was finally dissolved. The share is comparatively in a very good condition. Emblem of the Company with the inscription “J’appellerais volontiers l’économie la seconde providence du genre humain”, a quote from comte de Mirabeau. With the signature of Lafarge as Directeur général. VF. In the 18th and 19th century, tontines were commonly used investment plans for raising capital. They combined features of a group annuity and a lottery. Each subscriber paid an agreed sum into the fund, and thereafter received an annuity. As members died, their share in the tontine was distributed to the other participants, resulting in an increase in the value of each of the remaining members’ annuity. Upon the death of the last member, the scheme dissolved. Tontines are named after the Neapolitan banker Lorenzo de Tonti, who is credited with inventing them in France in 1653. However, his proposal was rejected by parliament in Paris. The first true tontine was therefore issued in the Netherlands in 1670. Tontines soon became a common financial tool for the Kings of France and England to fund military operations: Louis XIV first made use of tontines in 1689 and the British government first issued tontines in 1693 to fund a war against France during the Nine Years’ War.

Estimate

SFr300 to SFr400