Auction: SW1008 - Bonds and Share Certificates of the World

Lot: 240

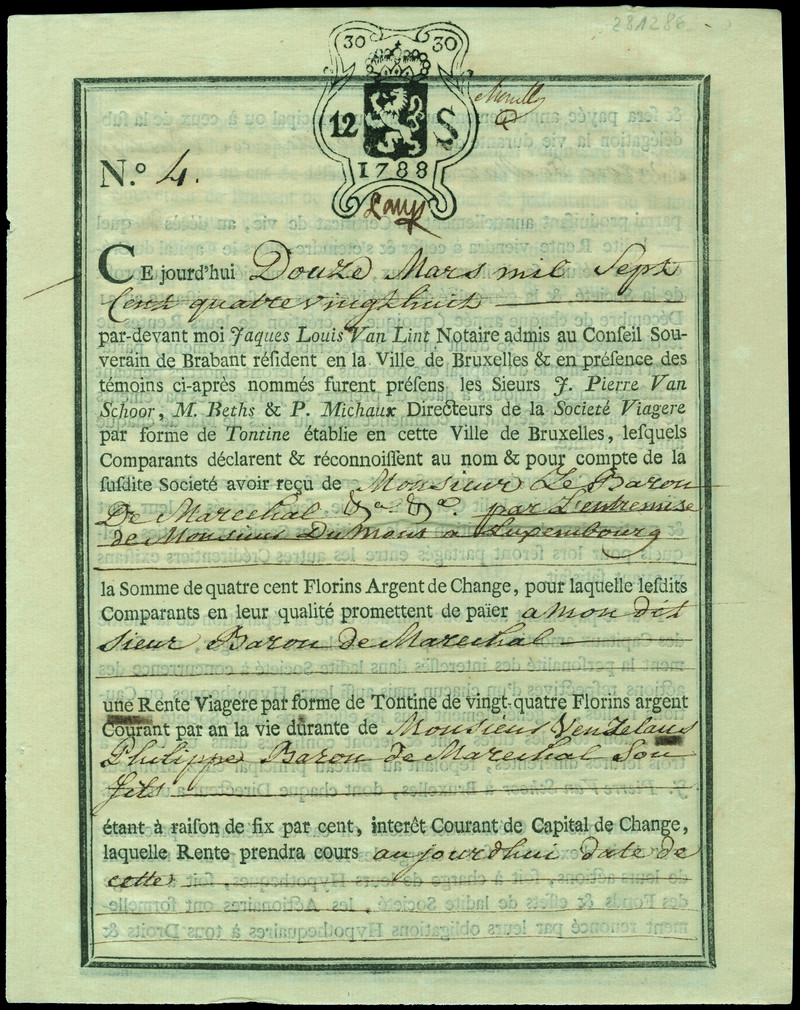

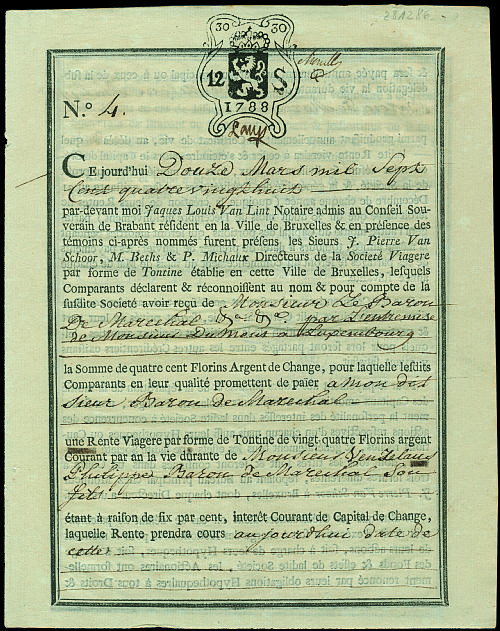

Tontines. Société Viagere par forme de Tontine. 6% Rente Viagère Tontine, 400 Guilders, 12. March 1788. Nr. 4. EF. In the 18th and 19th century, tontines were commonly used investment plans for raising capital. They combined features of a group annuity and a lottery. Each subscriber paid an agreed sum into the fund, and thereafter received an annuity. As members died, their share in the tontine was distributed to the other participants, resulting in an increase in the value of each of the remaining members’ annuity. Upon the death of the last member, the scheme dissolved. Tontines are named after the Neapolitan banker Lorenzo de Tonti, who is credited with inventing them in France in 1653. However, his proposal was rejected by parliament in Paris. The first true tontine was therefore issued in the Netherlands in 1670. Tontines soon became a common financial tool for the Kings of France and England to fund military operations: Louis XIV first made use of tontines in 1689 and the British government first issued tontines in 1693 to fund a war against France during the Nine Years’ War.

Sold for

SFr900