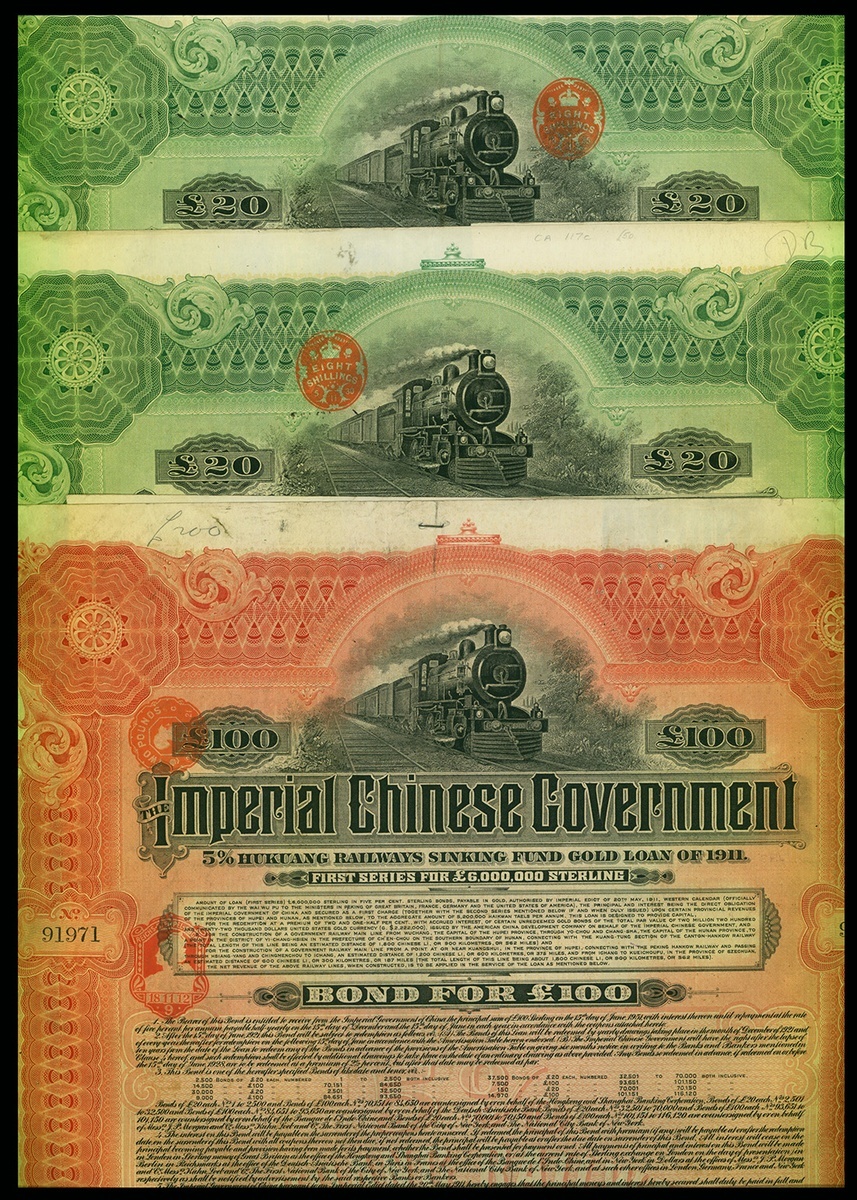

Auction: CSS36 - Banknotes, Bonds & Shares and Coins of China and Hong Kong

Lot: 18

1911 Imperial Chinese Government, 5% Hukuang Railways Gold Loan, 20 pounds (2) and 100 pounds, issued by Deutsch Asiatische Bank, The Hukuang Railways Loan of 1911 was for the capital sum of

£10,000,000 of which only the first series of £6,000,000 was issued.

The first series of the loan was, “…authorized by Imperial Edict of

20th May 2011, western calendar (officially communicated by the

Wai Wu Pu to the ministers in Peking of Great Britain, France,

Germany and the United States of America). The principal and

interest being the direct obligation of the Imperial Government of

China and secured as a first charge (together with the second series

mentioned below if and when duly issued) upon certain provincial

revenues of the province of Hupei and Hunan.”

The participating financial institutions which handled the

arrangements for the issuance of bearer bonds were:

The Hongkong and Shanghai Banking Corporation which

issued £1,500,000 in London at 99¾% and in Shanghai at 95%;

Banque de l’Indo-Chine which issued £1,500,000 in Paris at

100½%;

Deutsch-Asiatische Bank which issued £1,500,000 in Berlin at

100%; and

New York Banks: J.P. Morgan & Co, Kuhn, Loeb & Co, the First

National Bank of the City of New York and the National City Bank

of New York which jointly issued £1,500,000 in New York at 97%.

The various denominations of bearer bonds issued by these four

banks are shown on the data tables above.

Coupons were payable on 15 June and 15 December each year.

Scroll down or click

link for Illustration

KUHLMANN - 230

KUHLMANN - 231

KUHLMANN - 232

KUHLMANN - 233

KUHLMANN - 234

KUHLMANN - 235

KUHLMANN - 236

KUHLMANN - 237

Back to Main Index

Page...152

The historical events which were linked to this loan were dramatic.

The opposition to the loan agreements, coupled with public outrage

at the Imperial Chinese Government’s decision to not only

nationalise all of China’s Railways, but also to grant major

concessions to foreigners, significantly contributed to the downfall

of 3,000 years of imperial dynastic rule.

The initial loan agreement was negotiated by the British & Chinese

Corporation, but then French and German interests exerted pressure

to be allowed to participate in the financing of the project, and finally

the direct intervention of American President, William Howard Taft,

secured a share of this project for American capital enterprises.

The loan was secured upon a first charge of salt, rice and likin1 taxes

of Hunan and Hupeh which resulted in opposition from provincial

governments as well as from a rich merchant group who were

advocates of the “Rights Recovery Movement”. This group

demanded cancellation of the Hukuang Railways Loan, mainly as

they wished to promote their own business interests and gain a share

in the various infra-structure development programmes. However

there was also a patriotic element to this movement as there was

considerable objection to the granting of extra-territorial rights and

jurisdiction over sections of Chinese territory to foreigners.

Attempts by the central Imperial Government to pacify the leaders

of the “Rights Recovery Movement” failed and the opposition groups

actively mobilised students, workers and peasants to make violent

protests against the Chinese Imperial Government.

Although there were many contributing factors, the controversy

surrounding the Hukuang Railway Loan of 1911 and the subsequent

reaction by the Chinese population at large, is believed to be one of

the sparks that ignited the Chinese Revolution and significantly

contributed to the downfall of the Chinese Imperial Government.

(K-234, K-235), very fine (3)

1911年湖廣鐵路借款公債,德華銀行發行20及100鎊債票各2枚,VF

Sold for

HK$1,800