Auction: 317 - The Collector's Series

Lot: 462

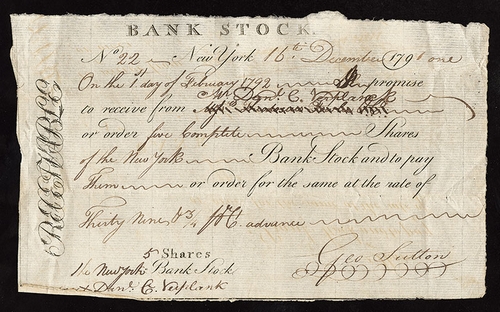

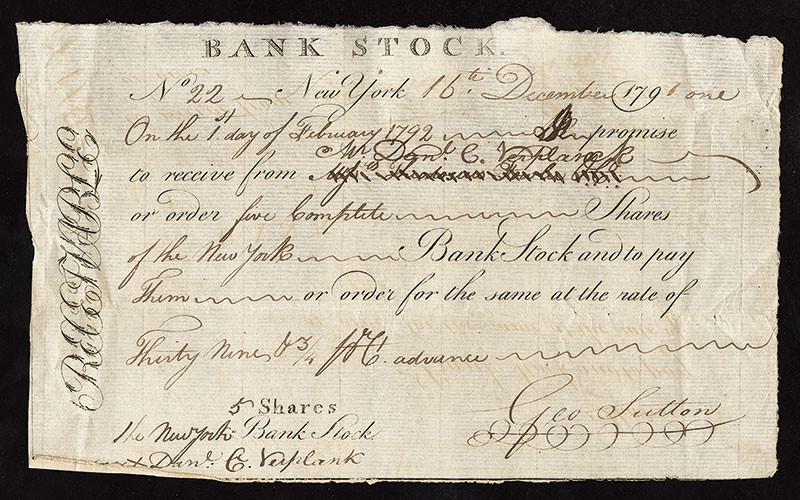

Bank of New York. Partially printed form. Dec. 16, 1791. No.22. 20mm x 13mm. "RECEIVABLE" for 5 Shares. $39.75 per share. "BANK STOCK" engraved at the top. Signed by George Sutton. "RECEIVABLE" forms the left end panel. Very Fine, with a few petty pin holes and a minor ink erosion hole.

The text reads:

"On the 1st day of February 1792 I promise to receive from Mr. Danl. C. Verplanck or order five Complete Shares of the New York Bank Stock and to pay them or the order for the same at the rate of Thirty Nine & 3/4 advance."

This transaction is similar to those described in the previous two lots. It is interesting to note that it is referred to on the form as a "RECEIVABLE." Since this is a pre-printed form, transactions of like this one must have occurred on a fairly regular basis, but this is the only partially printed form of this type we have ever had the privilege to offer at auction. It is the only one we found in the Verplanck archive.

The Bank of New York.

The third oldest bank in the United States was founded on June 9, 1784. Alexander Hamilton was the driving force behind the Bank, organizing it and writing its constitution. The bank opened for business at the Walton House in lower Manhattan only a few months after the departure of British troops from American soil. Like the New-York Manufacturing Society, the Bank would not receive a corporate charter from New York State until 1791.

In 1791, the Bank of the United States was not entirely ready for business. When Alexander Hamilton, as Secretary of the Treasury, needed help responding to a financial crisis caused by large scale speculation, he turned to the Bank of New York.

In December of 1791 when this "RECEIVABLE" was issued, William Duer was secretly at work mobilizing a group of New York speculators in an attempt to manipulate the New York stock market. He made massive purchases of government paper and bank stocks, driving prices up and creating a bubble that was bound to burst. The rapid rise in stock prices was probably the reason Verplanck failed to exercise this receivable option, which would explain why the document remained in his business papers until now.

This rare, and possibly unique example was issued at a time when the United States was experiencing its first taste of turmoil in the financial markets. The actions that Alexander Hamilton took to deal with the financial market disruptions known as the Crisis of 1791 and the Panic of 1792 were not all that different from those employed to prevent modern market meltdowns.

Clearly, no collection of early American financial history will be complete without it.

Sold for

$12,500