Auction: 317 - The Collector's Series

Lot: 460

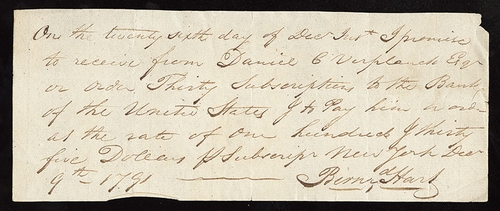

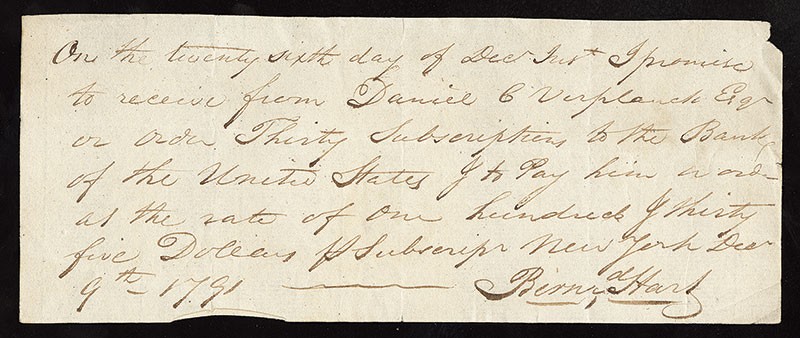

Bank of the United States. Manuscript agreement to purchase 35 Subscriptions. December 9th, 1791. 20.5cm x 8cm. Issued to Daniel C. Verplanck. $135 per subscription. Payable December 26th, 1791. Signed by Bernard Hart, one of the original signers of the Buttonwood Agreement. VF-EF.

The text reads as follows:

"On the twenty sixth day of Dec. Inst I promise to receive from Daniel C. Verplank Esq or order Thirty Subscriptions to the Bank of the United States & to Pay him or order at the rate of one hundred & thirty five Dollars per Subscrip New York Dec. 9th 1791." Signed Bernard Hart.

Bernard Hart (1764-1855):

There were five Jews among the signers of the Buttonwood Agreement - Benjamin Seixas, Ephraim Hart, Bernard Hart, Isaac M. Gomez, and Alexander Zuntz, a Hessian soldier who had worked for the British during the American Revolution.

Bernard Hart came to New York from Bavaria in 1780. He became a successful businessman, an active member of the Jewish Synagogue, a member of the Black Friar's Society, the House of Lords, and the St. George's Society. Hart was a partner in the firm of Lispenard & Hart. He married Zipporah Seixas, the daughter of one of the other Jewish signers of the Buttonwood Agreement, Benjamin Seixas.

Bank of United States "Scrips" (Subscriptions)

In December 1790 Alexander Hamilton asked Congress to incorporate a Bank of the United States. One quarter of the subscription price was to be paid in gold or silver coins, bullion, or plate. The remainder was to be payable in U.S. debt securities obtained by trading old debt for new debt.

In early 1791, both houses of Congress passed the Bank bill. After a great deal of debate on the constitutionality of the bill, George Washington signed it in late February.

The intial public offering for Bank of the US "scrips" took place on July 4, 1791. Investors paid $25 in specie (gold, silver) per scrip. A $100 was due on January 1, 1792. Another $100 was then due on July 1, 1792. A payment of $100 was due on January 1, 1793, and a final payment of $75 was due on July 1, 1793. The total price per share was $400.

The scrips were soon the target of intense speculation. They went from $25 to $50 in the first few weeks. The scrips rose from $50 to over $300 each, then the bubble burst and they declined back down to the $120-$130 range. At this point, Verplank optained an obtion from Bernard Hart.

On December 9th, 1791 Bernard Hart promised to purchase from Daniel C. Verplank thirty-five Bank of the United States subscriptions at $135 each, if received on December 26th, 1791.

If Verplanck obtained his scrips through the initial public offering he stood to gain $110 per scrip by excercising his option. The fact that this document remained among Verplanck's business papers indicates Verplanck did not execrcise the option. The reason is almost certainly due to the fact that Bank of the US scrip prices rose throughout December of 1791.

This superb example of a stock transaction between a wealthy New York real estate investor, and one of the signers of the Buttonwood Agreement, will be a prize piece for any advanced collector of early American financial history.

Sold for

$12,000