Auction: 24009 - World Banknotes

Lot: 9

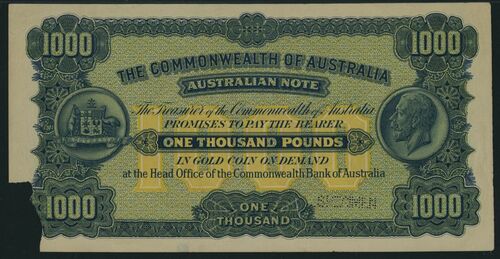

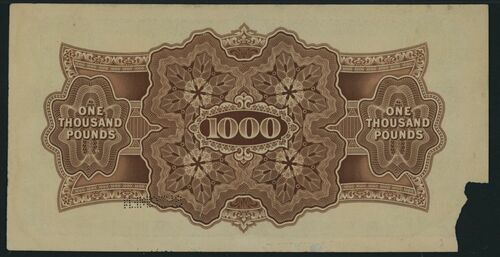

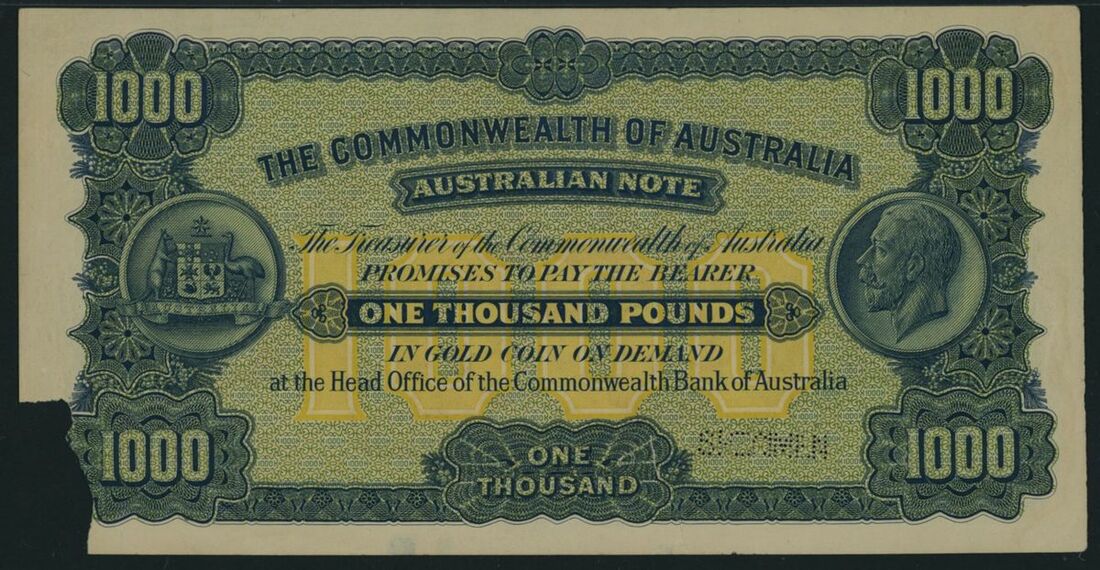

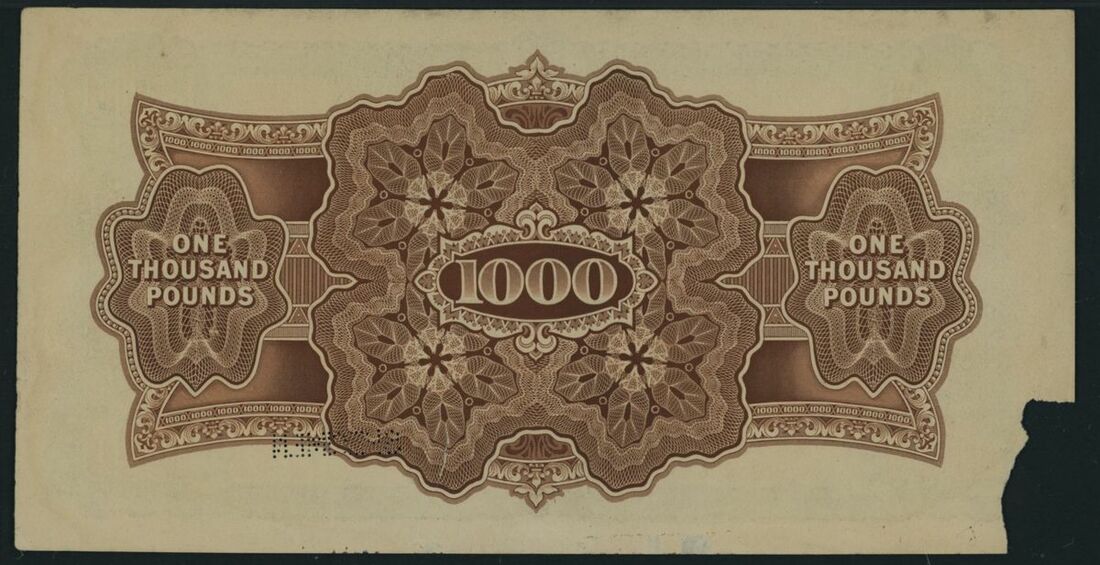

Commonwealth of Australia, specimen £1000, ND (1923),

in the aftermath of World War I, Australia found itself navigating a period of recovery, growth, and modernisation. Central to this new chapter was the establishment of a strong, unified financial system that reflected the country's increasing economic independence and stature in the global arena. A critical component of this evolution was the creation of a national currency system, a project that not only symbolised Australia's separation from British monetary reliance but also marked a new era of financial stability and self-determination.

The path to a unified Australian currency began in earnest on 1st January 1901, when the six British self-governing colonies-New South Wales, Queensland, South Australia, Tasmania, Victoria, and Western Australia-came together to form the Commonwealth of Australia. With federation, the newly formed Australian Parliament was granted authority over banking and currency matters, sparking a long journey toward establishing a truly national currency. This journey began with the passage of the Australian Notes Act of 1910, which assigned the responsibility for issuing banknotes to the Commonwealth Treasury. Additionally, the Act made it illegal for any bank to circulate state-issued notes, giving the government exclusive control over the nation's currency.

To further consolidate control, the Bank Notes Tax Act of 1910 imposed a 10 percent annual tax on privately issued banknotes, effectively discouraging their circulation. Together, these two legislative measures laid the foundation for a centralised currency system under the Commonwealth's authority, reducing the fragmentation caused by state-based currencies.

A major milestone in Australia's journey toward currency centralisation was the establishment of the Commonwealth Bank of Australia in 1911. Initially, the bank operated as a commercial and savings bank, with the issuance of banknotes still under the purview of the Treasury. However, by 1920, this responsibility was transferred to the newly formed Notes Board, which was chaired by the Governor of the Commonwealth Bank. The Notes Board was responsible for managing the issuance of notes, while the Commonwealth Bank took on the role of administering the process.

In 1924, further amendments to the Commonwealth Bank Act gave the bank direct control over the issuance of notes, effectively centralising Australia's currency system. This shift marked a significant step toward modernising and stabilising the country's financial infrastructure. Under the leadership of Thomas Samuel Harrison, Australia's first official banknote printer, the nation's first banknote printing facility was established in Melbourne in 1912. By 1st May 1913, the first Australian banknotes had been produced, marking a critical moment in the nation's financial history.

Initially, denominations ranging from 10 shillings to 10 pounds were issued, reflecting the needs of the general public and businesses. However, as Australia's economy expanded, so too did the need for higher denominations. In 1914, the Commonwealth Treasury introduced the £1,000 note, a high-value currency primarily designed to facilitate interbank settlements, where large sums of money needed to be exchanged without the need for physical gold transfers.

At that time, 88,585 Collins/Allen £1,000 notes were printed, but only 52,600 were believed to have been released into circulation. The high value of the note, equivalent to about a year's wages for the average Australian, limited its everyday use. In fact, the notes were largely utilised by banks to settle balances between themselves, especially after the outbreak of World War I, when the public began hoarding gold coins, shrinking the availability of circulating currency.

Although the £1,000 note played an essential role in interbank transactions, concerns about its vulnerability to forgery emerged soon after its release. In June 1915, Denison Miller, Governor of the Commonwealth Bank, advised the Secretary of the Commonwealth Treasury, George Allen, that there were "enormous risks" associated with the note's inconsistent colour, size, and paper quality. Miller's concerns prompted a letter to Allen suggesting that the note should no longer be issued to the public. Instead, it was recommended that the £1,000 note be restricted to internal banking transactions and interbank settlements.

By mid-1915, the Commonwealth Treasury had adopted Miller's recommendations. The £1,000 notes were pulled from general circulation, and banks were instructed to withhold any received notes from reissue, limiting their use to interbank transfers.

Despite the strict regulation of the £1,000 note, concerns about forgery continued into the early 1920s. The Notes Board resolved on 23rd October 1922, that a new design for the £1,000 note should be developed. The production of this new note was entrusted to the renowned Bradbury Wilkinson & Co. in England, reflecting the technical limitations of Australia's printing capabilities at the time. By 18th May 1923, a specimen of the redesigned £1,000 note was received in Australia and was promptly approved by the Notes Board. Due to shortages in the specific paper required for its production, however, the Board authorised the use of handmade watermarked paper, typically reserved for Commonwealth Treasury Bonds, on 7th July 1924.

Plans for the issuance of the new note progressed steadily. The plates and blocks for the £1,000 note were engraved by Perkins Bacon & Co. Ltd. in 1925, and preparations for the printing process in Australia were underway. However, a crucial decision was made on 5th June 1928, to cancel the issuance of the new £1,000 note. The rise of central reserve banking had dramatically reduced the need for such high-denomination notes for interbank transfers, leading the Notes Board to conclude that the expense of producing the new design was no longer justified.

Despite the cancellation of the new design, the original £1,000 notes continued to circulate until their official withdrawal in June 1969. Interestingly, even though all Imperial notes were removed from circulation following the introduction of decimal currency in February 1966, the £1,000 note remained in limited use for another three years, primarily for internal transactions between the Reserve Bank's Note Issue Department and the Banking Section in Sydney.

The destruction of the remaining 29,000 notes in 1969, valued at $58 million, marked the end of the £1,000 note's long and storied history. Photographs documenting this event serve as a testament to the currency's final chapter.

The Type Two Specimen £1,000 note, despite never being issued for public circulation, holds a unique place in Australian numismatic history. Its rarity, combined with its intricate design and the historical significance of its creation, makes it one of the most sought-after collector's items in the world of banknotes. Only one other known specimen survives today, further elevating its status as an unparalleled trophy item.

For both Australian numismatists and international collectors, this rare specimen represents an extraordinary opportunity to own a piece of Australia's financial history. Its museum-grade quality, combined with its exceptional rarity, positions it as a centrepiece for any world-class collection, whether displayed in a prestigious institution or held in the private vault of a renowned collector. Acquiring this note would not only offer a tangible connection to Australia's economic evolution but also enhance the prestige of any collection in which it resides,

(Pick Unissued), in PMG holder 50 About Uncirculated, corner missing, tears

Subject to 20% VAT on Buyer’s Premium. For more information please view Terms and Conditions for Buyers.

Sold for

£15,500