Auction: 13017 - Bonds and Share Certificates of the World

Lot: 477

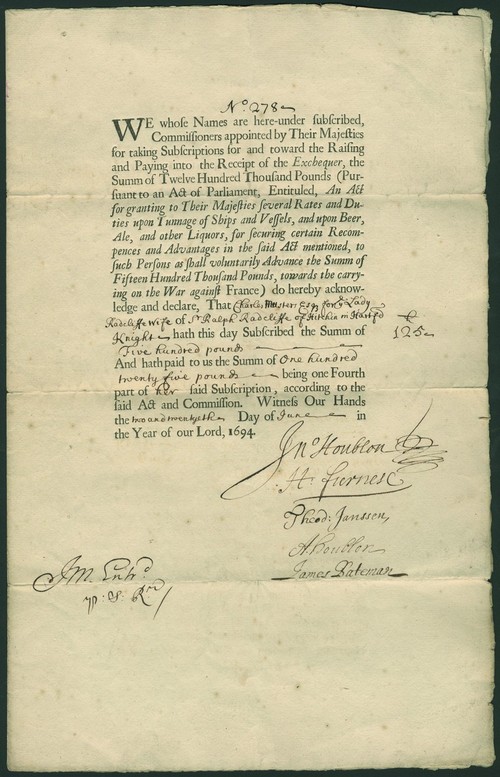

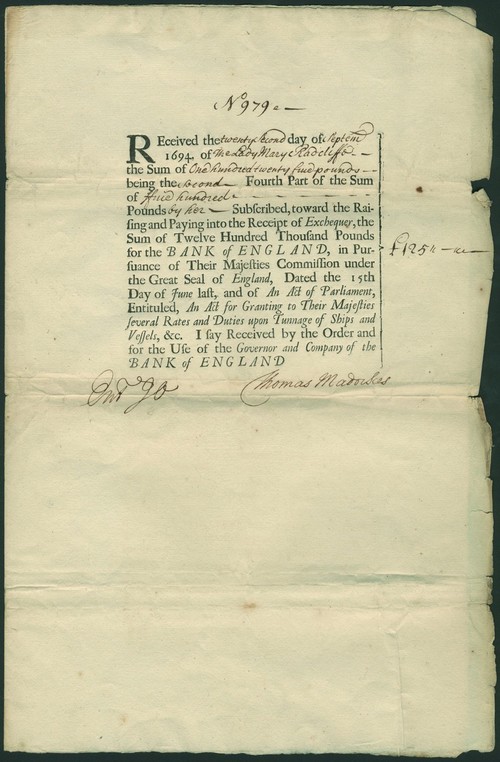

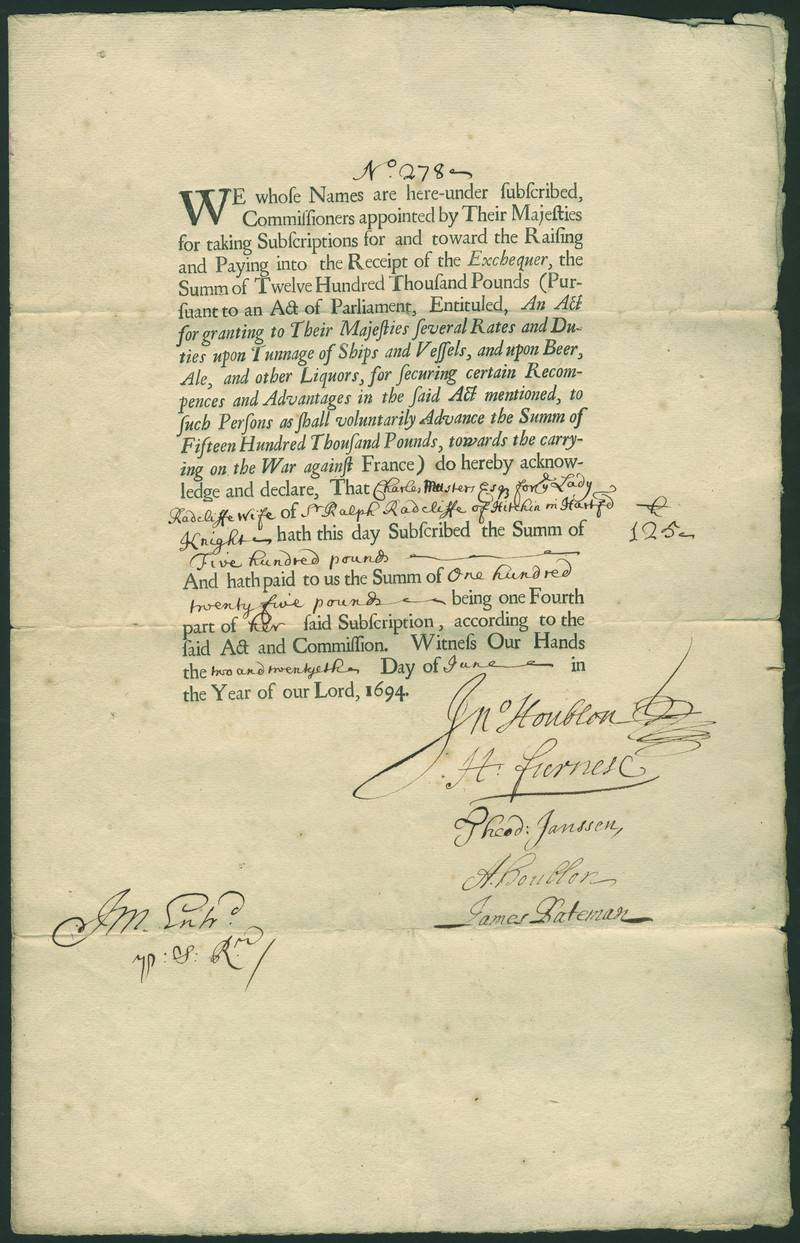

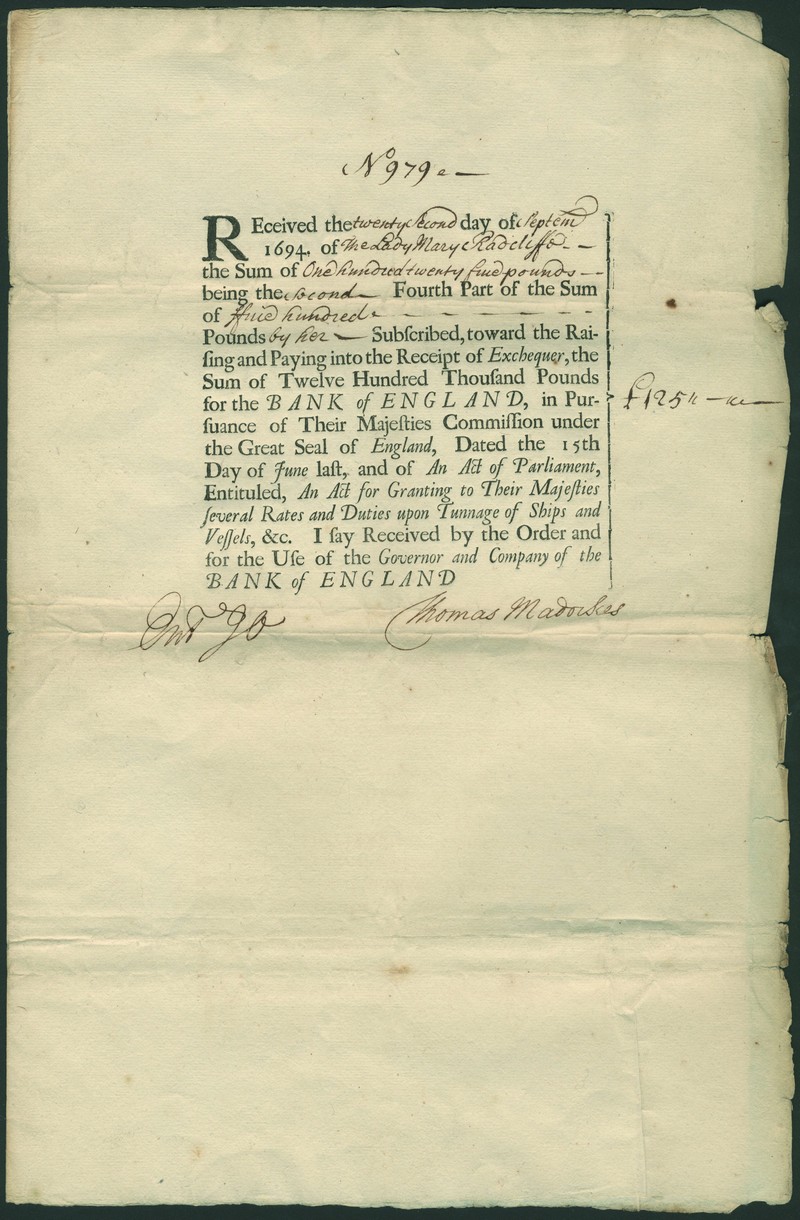

Bank of England: First Subscription to the Bank, 1694, a pair of documents for a subscription of £500 made by Sir Ralph Radcliffe (1633-1720) for his wife, the first dated June 1694 when the Government were raising funds to create the bank, the second dated September 1694, just after the Bank had been formed, for the second payment of £125, both folio, 4 pages, black printing, very fine and extremely rare. (2)

It started, as so often, with war. Much of the attraction to William III of the offer of the throne of England was that he could thereby mobilise our forces against the French in defence of Holland.. Accordingly Britain was embroiled in a European war on a scale hitherto unknown. As a result, annual expenditure escalated from perhaps £1.4m. to £4.0m. with income a little over £1.0m. Prior to William's accession the constitutional theory had been that "the King shall live of his own", that is Parliament might vote annual taxes or duties for the nation's upkeep, but any inadequacy, in particular most types of borrowing, was a matter for the King. As he could not be sued and, in theory, his debts died with him, his credit rating was poor and the nation's finances difficult to manage. The beginnings of goldsmith banking, so much involved with advances to the State, owed much to investors' belief that depositing monies with the bankers for onward transmission was a better credit risk than direct investment at the Exchequer. Such deposits were usually to be repaid "in course", that is they would be secured on an annual tax or duty and repaid, with interest, as the resulting revenue came to hand.

The offer to William had included the condition Parliament would take over control of most types of borrowing. It may have taken on the task with some misgiving. For a nation which habitually ran a current account deficit, the "in course" system could no longer cope. So the new government of the Glorious Revolution of 1688 had to experiment with schemes of longer term borrowing. The first, in 1693, was to raise £1.0m. by way of a tontine. It was unsuccessful, a little more than £100,000 being taken up. The following year saw numerous novel ways of raising money, including the first Exchequer Bills, loans from the East India Company, the first State lottery (which spawned the Million Bank, which was not a bank at all), issues of life annuities - and the founding of the Bank of England.

The five signatories on the larger receipt - Sir John Houblon, Sir Henry Furnese, Sir Theodore Janssen, Abraham Houblon and Sir James Bateman signed in their capacities as Commissioners appointed under the Great Seal of England to take the subscriptions, but their greater significance is their subsequent election as directors. The first Board contained three Houblon brothers, merchants whose grandfather had fled France at the time of the Alva persecutions. Sir John became the Bank's first Governor, and the present Threadneedle St. building includes the site of his one time house. Furnese was a trader in point lace. Janssen and Bateman (a later Bank Governor), both immigrants from the Continent, later made the mistake of deserting the Bank in favour of the South Sea Company. Bateman was the first sub Governor there but died before the years of the bubble: Janssen, despite his reputation for honesty remained to be fined over £200,000. Maddocks, who signs the smaller receipt was at that time the junior of the initial cashers, although he was soon to became Chief Cashier and his autograph is much sought after as a signatory on the first banknotes.

The £1.2m. capital raised was to be lent wholly to the Government at 8%p.a, the interest to be financed by levying a duty "upon the Tunnage of ships and vessels" and thus the Bank became the Tunnage bank to its detractors. In return for the loan, the Bank was to be granted a charter and the right to issue £1.2m. of banknotes, secured only on that loan. e Chancellor of the Exchequer, fearful of failure, provided for a further £300,000 to be raised in the form of annuities, which is why the Act refers to £1.5m. He need not have worried. e subscription for the Bank taken at the Mercers' Chapel, filled in 12 days. It had opened on June 21 1694, the Queen applying for £10,000. The first Radcliff e subscription receipt here illustrated is dated the following day. The Charter, and therefore the actual commencement of the Bank, was not sealed until 27th July: It is unlikely that another opportunity will occur to acquire a document dated at the very dawn of the Bank.

Subject to 20% VAT on Buyer’s Premium. For more information please view Terms and Conditions for Buyers.

Sold for

£62,000